To add or edit freight file details:

Refer to "Adding a New Freight Code" or "Updating a Freight Code".

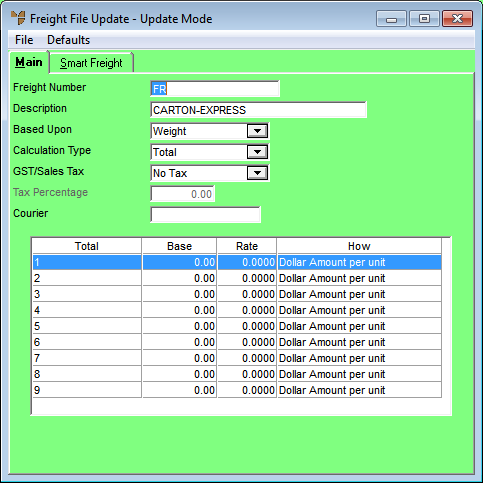

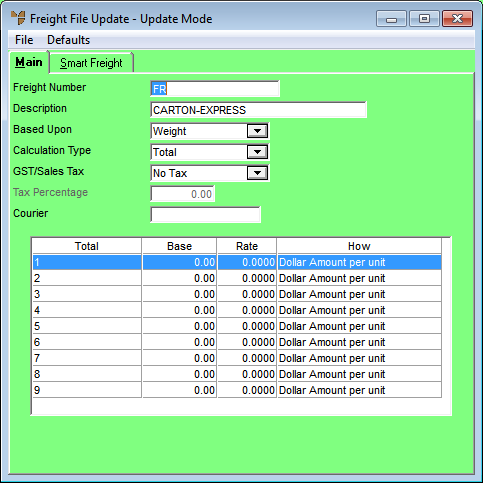

Micronet displays the Freight File Update screen - Main tab.

|

|

Field |

Value |

|---|---|---|

|

|

Freight Number |

Enter a unique ID of up to five characters for the freight code. Note that if you are using SmartFreight, this ID does not get passed to SmartFreight. |

|

|

Description |

Enter a description for the freight code. |

|

|

Based Upon |

Select the base on which freight should be calculated. Options are:

|

|

|

Calculation Type |

Select the calculation type for the base you selected in the previous field. Options are:

|

|

|

GST/Sales Tax |

Select No Tax, Tax % or Average Tax % depending whether the freight component should be taxed or not. |

|

|

Tax Percentage |

If you selected Tax % or Average Tax % in the previous field, enter the actual sales tax rate. |

|

|

Courier |

Enter or select the ID of the courier that this freight code applies to. If you select a courier, Micronet allows you to create a new courier on the fly if required. |

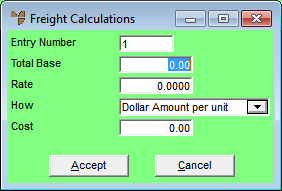

Micronet displays the Freight Calculations screen.

|

|

Field |

Value |

|

|

Entry Number |

Micronet displays the line number in the freight table. |

|

|

Total Base |

Enter the amount of the base (weight, volume, quantity, number of boxes delivered or order value). Micronet will apply the freight charge up to this quantity. |

|

|

Rate |

Enter the rate (value) of the freight to be charged, excluding GST. |

|

|

How |

Enter the way you want the freight charge calculated. Options are:

|

|

|

Cost |

Enter the cost to be posted to the General Ledger, if any. |